Rental Income Taxation Under Annual Regime

- Rent is charged on actual amount received

- Expense incurred to generate rent is allowed under section 15 of the Income Tax Act.

- Tax is calculated under individual graduated scale or corporate rate of 30%

- In addition, rent on non-residential buildings (Commercial) is taxable under the VAT Act(No. 35 of 2013) – Laws of Kenya.

How to determine Taxable Income

- Gross Rent income for the year:

Property A – 5 unitsKshs. 20,00012months 1,200,000

Property B – 10 unitsKshs. 15,00012months 1,800,000

Total Rent income in Kshs. 3,000,000

Less: Allowable expenses (Kshs.):

Land Rent/Rates 10,000

Insurance 20,000

Agent’s fees 30,000

Repairs 160,000

Loan interest 85,000

Electricity 60,000

Net taxable rent income (Kshs.) 2,635,000

Monthly Rental Income Tax (MRI)

- Charged under Section 6A of Income Tax ACt

- Introduced by Finance Act 2015

- Effective from 1st January 2016

What is Residential Rental Income?

This is tax payable by resident persons (individual or company) on rental income earned for the use or occupation of a residential property where the rent income is between Kshs. 288,000 (Kshs. 24,000 per month) and Kshs. 15 million per annum.

Note:

Landlords with rental income below Kshs. 288,000 or above Kshs. 15 million per year shall be required to file annual income tax returns and declare this rental income together with income from other sources.

What is the Tax Rate?

Residential rental income is charged at a flat rate of 10% on gross rent received per month

It is payable when landlords receive rent from their tenants either monthly, quarterly, semi-annually or annually. However, returns must be filed monthly.

No expenses, losses or capital deduction allowances shall be allowed for deduction from the gross rent.

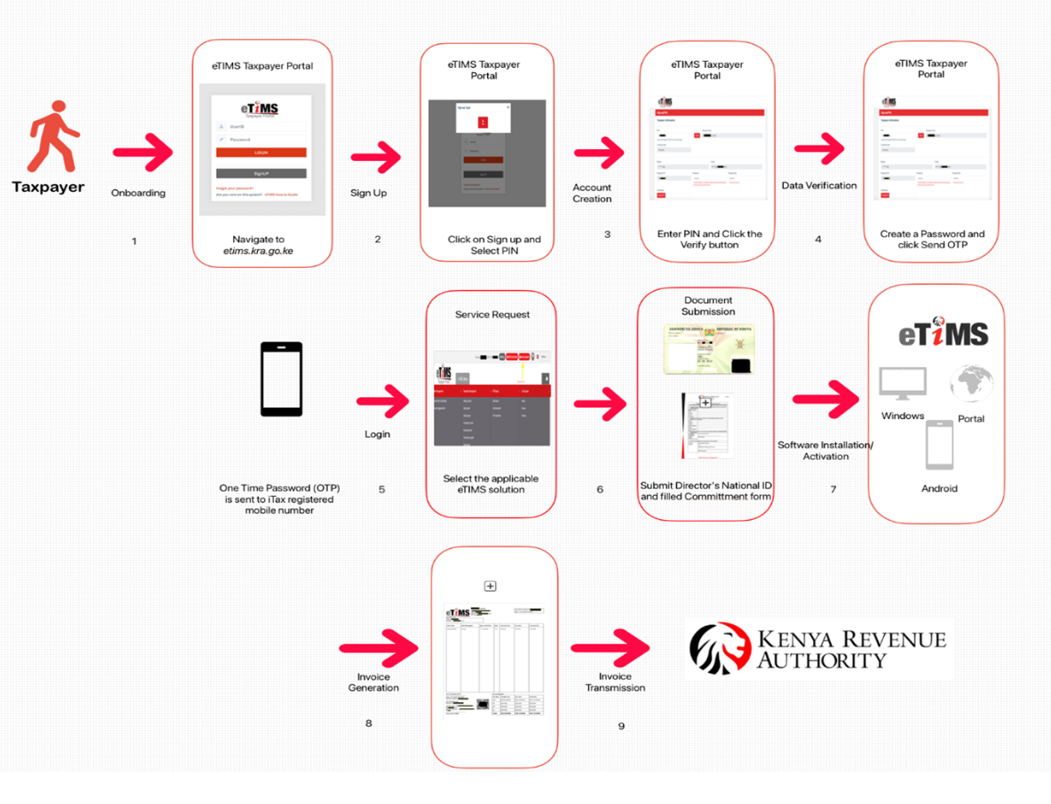

How do I file for Residential Rental Income?

Rental Income is filed on or before the 20th of the following month. For example, rent received in January is declared and tax paid on or before 20th February.

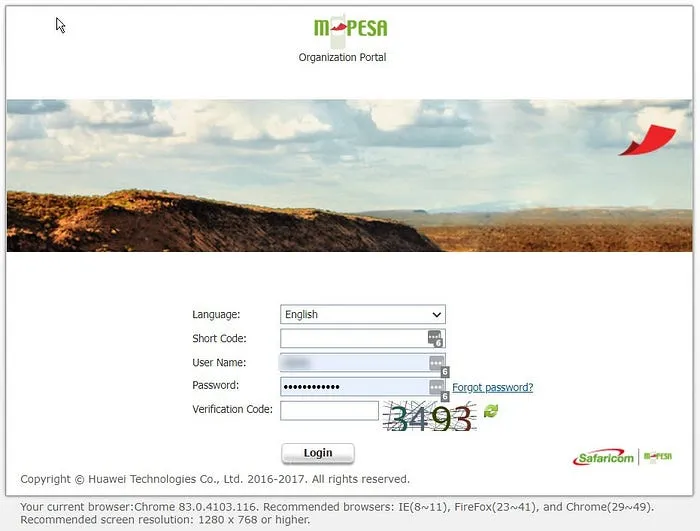

Complete a monthly tax return online via iTax by declaring the gross rent and tax payable will be computed automatically at a rate of 10%.

For any month that the landlord does not receive any rent he/she shall file a NIL return.

Residential rental income is final tax therefore, persons are not required to declare the same in their annual income tax returns.

You can now also file and pay your monthly rental income tax using the new KRA M-service App  .

.

Exemptions

The simplified tax does not apply to:

- Non-residents

- Landlords earning more than Kshs. 15M pa

- Taxpayers who wish to remain in current tax regime on rental income may elect to do so by writing to Commissioner.

What is the penalty for late filing and late payment of MRI?

Date: Returns are filed and tax payable on or before the 20th of the following month.

Penalty on late filing: Late filing of MRI returns attracts a penalty of:

- 2,000 or 5% of the tax due whichever is higher for individuals

- 20,000 or 5% of the tax due whichever is higher for corporates

Penalty on late payment:

- 5% of the tax due and

- late payment interest of 1% per month on the unpaid tax until the tax is paid in full.

74 total views , 1 views today

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)