The Electronic Tax Invoice Management System (ETIMS) is transforming how businesses manage their tax obligations. Developed to streamline compliance with tax regulations, ETIMS is especially significant for enterprises in regions where tax authorities are modernizing their systems. In this post, we delve into what ETIMS is and explore its numerous benefits for businesses.

What is ETIMS?

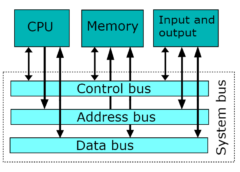

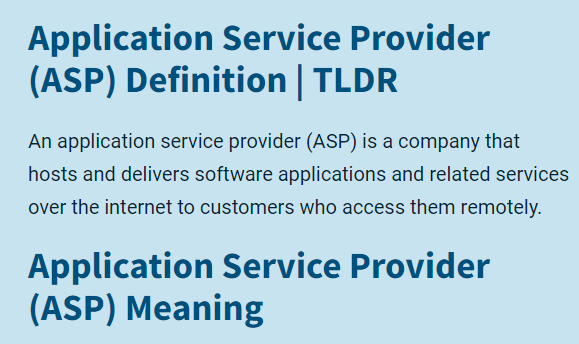

ETIMS is an electronic solution designed to enhance the management of tax invoices. It integrates seamlessly with point-of-sale (POS) systems to generate real-time electronic invoices that are directly transmitted to tax authorities. By adopting ETIMS, businesses ensure compliance with tax laws while simplifying their invoicing processes.

Key Benefits of ETIMS

- Enhanced Compliance

ETIMS automates the generation and submission of tax invoices, ensuring adherence to tax regulations. This reduces errors and eliminates non-compliance risks that can lead to penalties. - Improved Efficiency

Manual invoicing processes can be time-consuming and prone to mistakes. ETIMS streamlines these tasks, saving time and resources while boosting operational efficiency. - Transparency and Trust

With real-time data sharing between businesses and tax authorities, ETIMS fosters transparency. This builds trust among stakeholders and demonstrates a commitment to lawful operations. - Accurate Record-Keeping

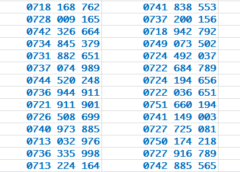

ETIMS maintains a digital record of all transactions, simplifying audits and tax filing. Businesses no longer need to rely on cumbersome paperwork or worry about misplaced documents. - Fraud Prevention

The system minimizes fraudulent activities by ensuring that all invoices are tracked and reported. This enhances the integrity of financial transactions. - Cost Savings

Although implementing ETIMS involves initial investment, it reduces long-term costs associated with audits, penalties, and manual invoicing errors. - Scalability

ETIMS is designed to accommodate businesses of all sizes. Whether you’re a small enterprise or a large corporation, the system can be tailored to meet your needs.

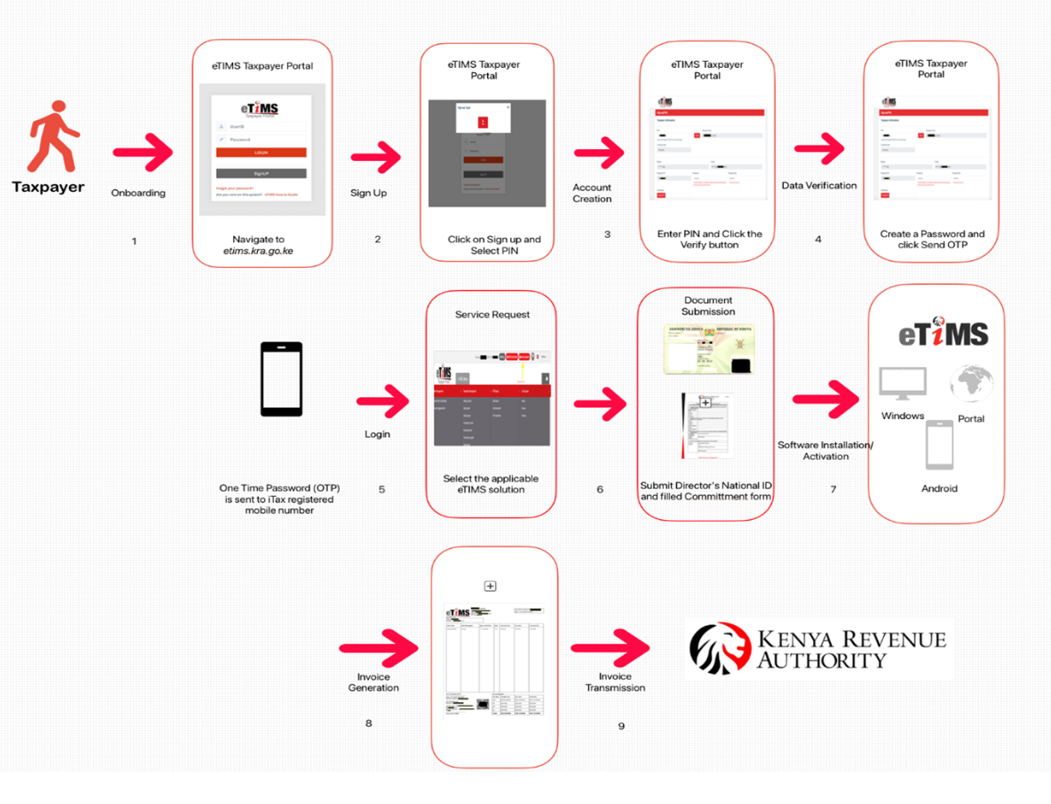

How to Implement ETIMS

Adopting ETIMS involves integrating it with your existing POS system. Tax authorities or certified providers often supply the software and hardware components required. Businesses should ensure proper training for their staff to maximize the system’s potential.

![]()

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)