Nestict.com Linktree

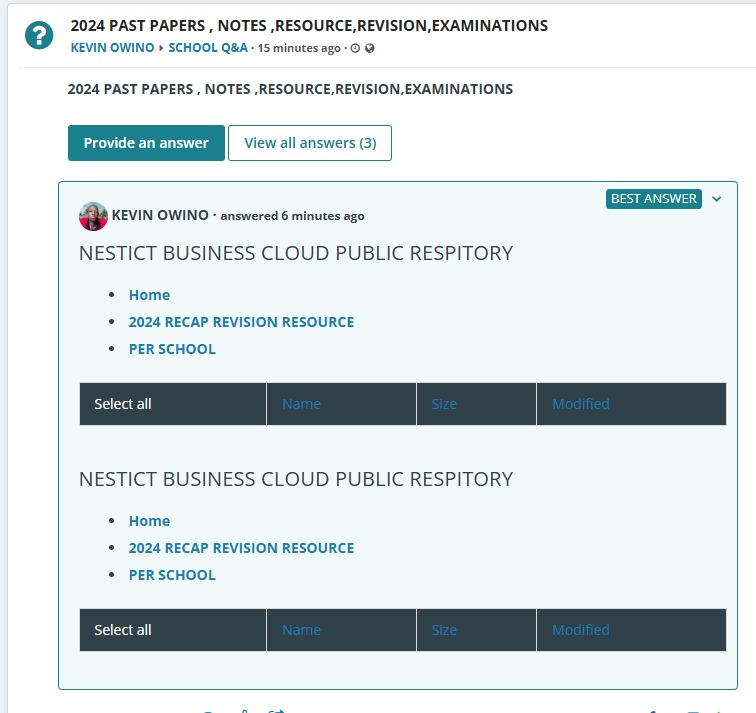

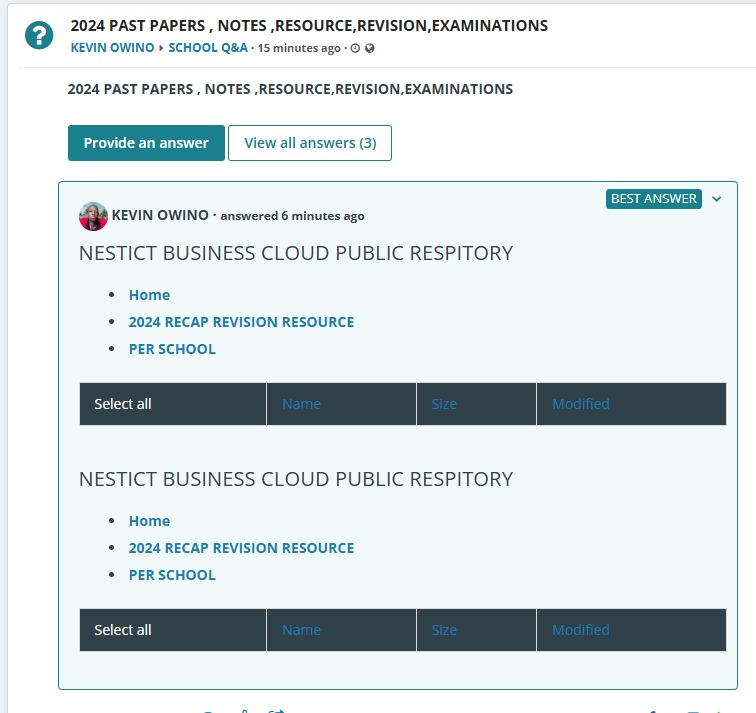

Forms CBC Leaving Form NPS Medical Examination Form Vendor Information Form JSS Exams Grade 7 Grade 7 Creative Arts & Sports Questions Grade 7 Christian Religious Education Questions Grade 7…

0 total views

Read moreFelis consequat magnis est fames sagittis ultrices placerat sodales porttitor quisque.

Forms CBC Leaving Form NPS Medical Examination Form Vendor Information Form JSS Exams Grade 7 Grade 7 Creative Arts & Sports Questions Grade 7 Christian Religious Education Questions Grade 7…

0 total views

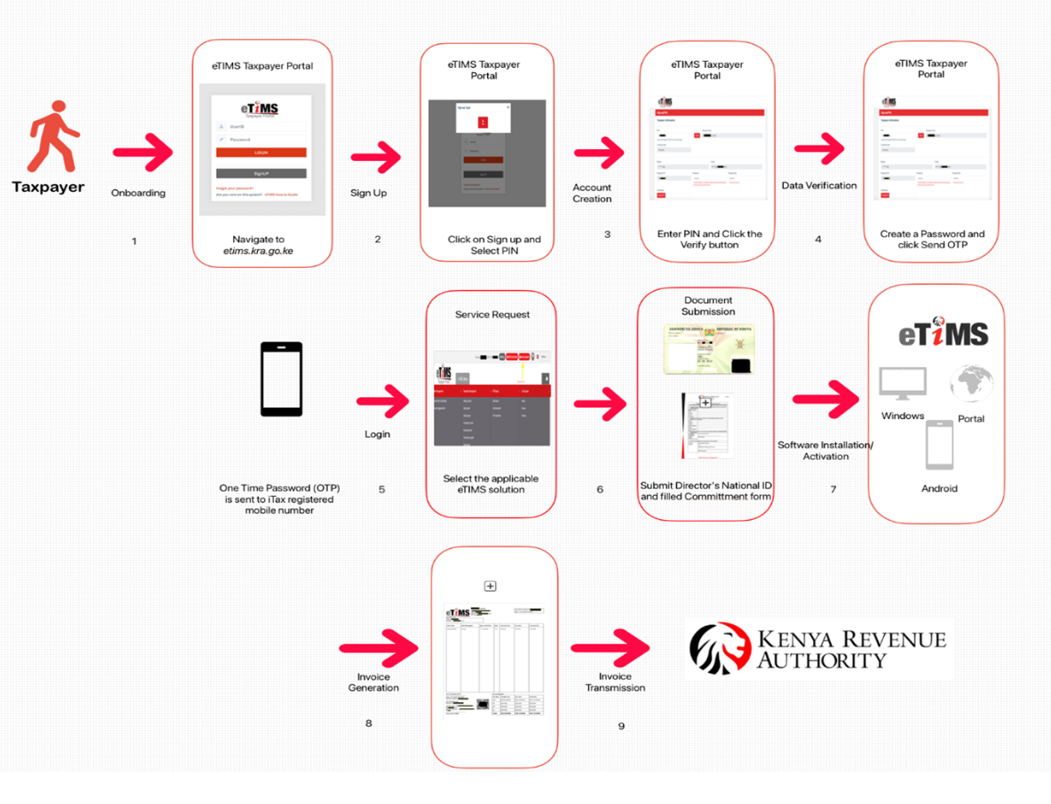

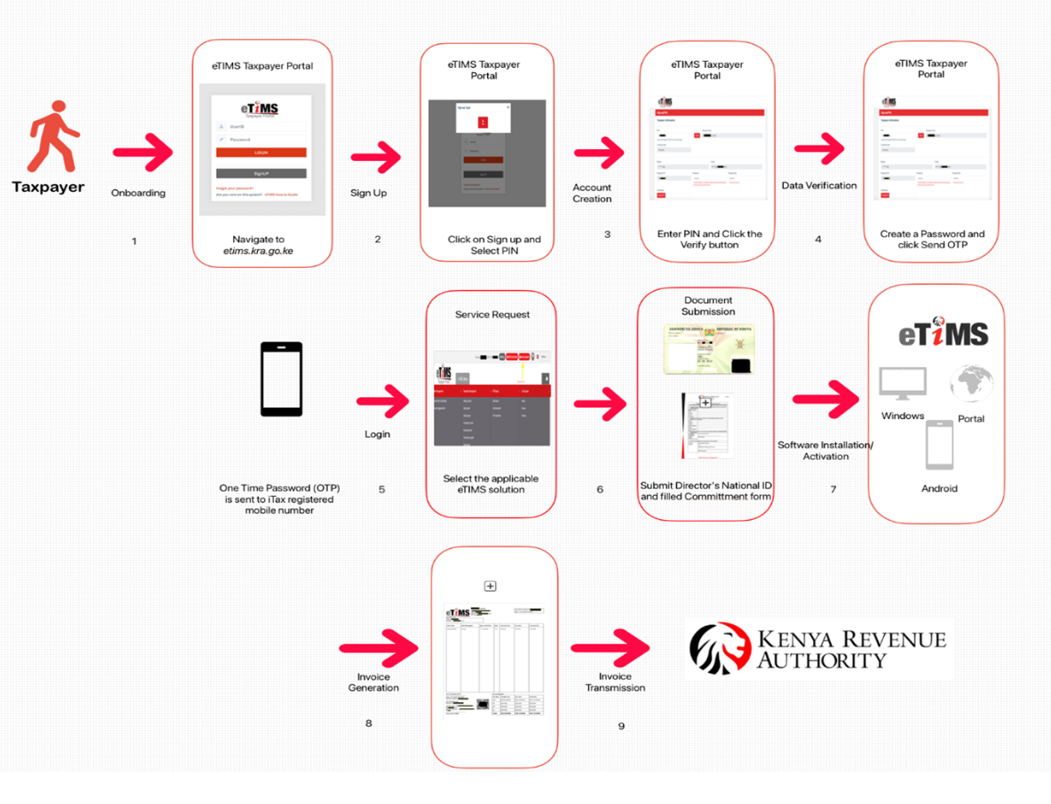

Read moreThe Electronic Tax Invoice Management System (ETIMS) is transforming how businesses manage their tax obligations. Developed to streamline compliance with tax regulations, ETIMS is especially significant for enterprises in regions…

21 total views

Read moreFile Your 2024 Returns Now As the year 2024 comes to an end, it’s time to start preparing for one of the most critical compliance tasks for every Kenyan taxpayer—filing…

97 total views

Read moreRental Income Taxation Under Annual Regime Rent is charged on actual amount received Expense incurred to generate rent is allowed under section 15 of the Income Tax Act. Tax is…

73 total views

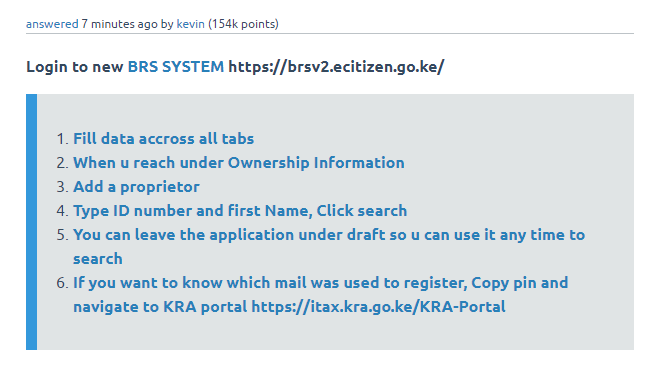

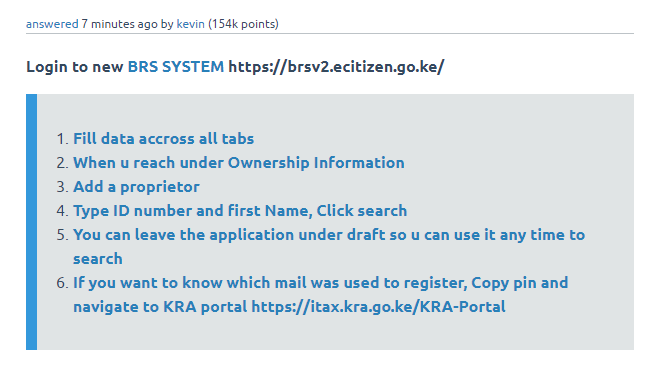

Read moreA PIN is a Personal Identification Number used while doing business with Kenya Revenue Authority, other Government agencies and service providers. Personal includes both individuals and artificial persons (i.e. company,…

37 total views

Read more

![[Assorted] Comprehensive List of Postal Codes in Kenya: From A to Z](https://www.blog.nestict.com/wp-content/uploads/2024/08/The-5-Best-Keyboards-For-Typing-Summer-2024-Reviews-RTINGS.com_.jpg)

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

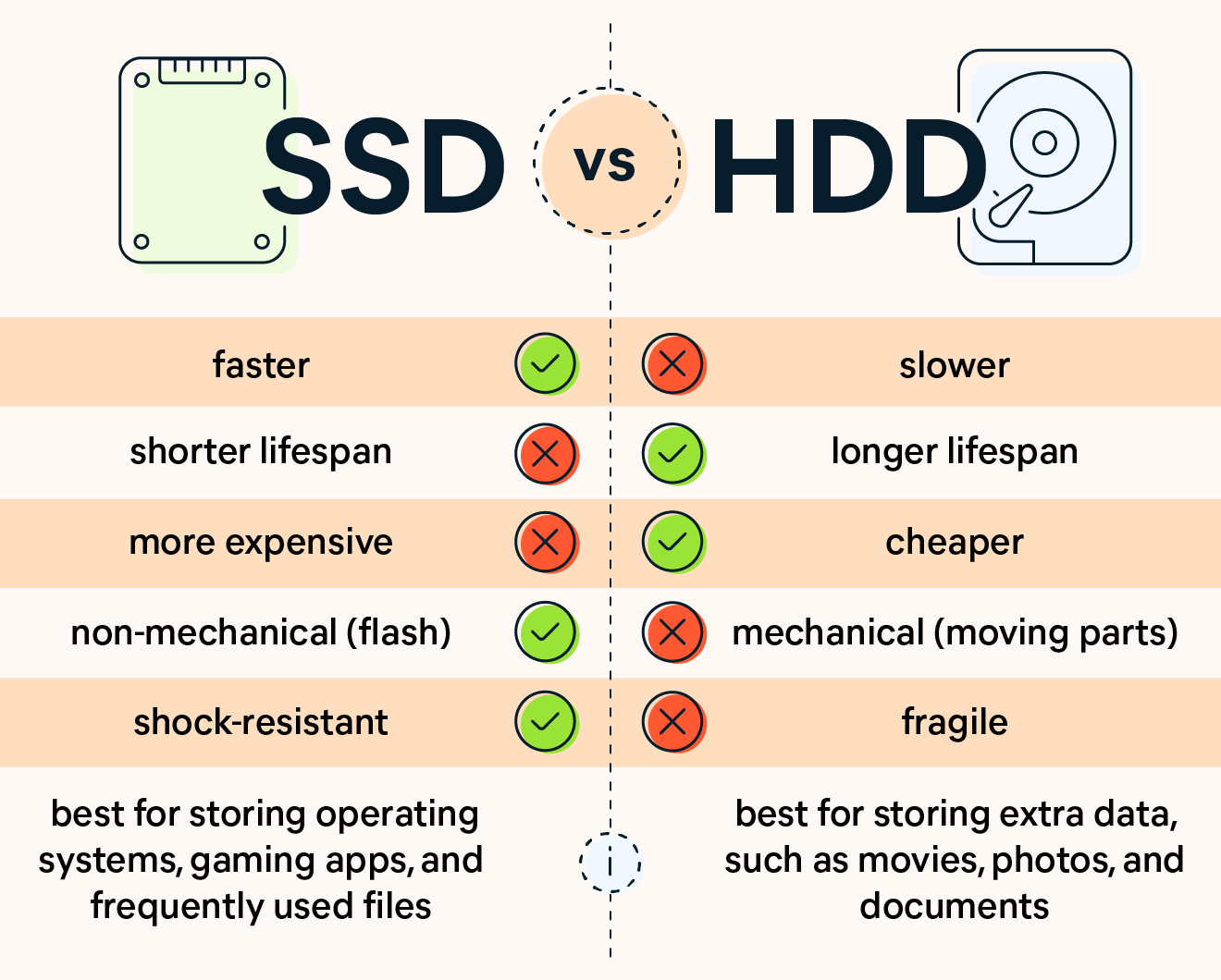

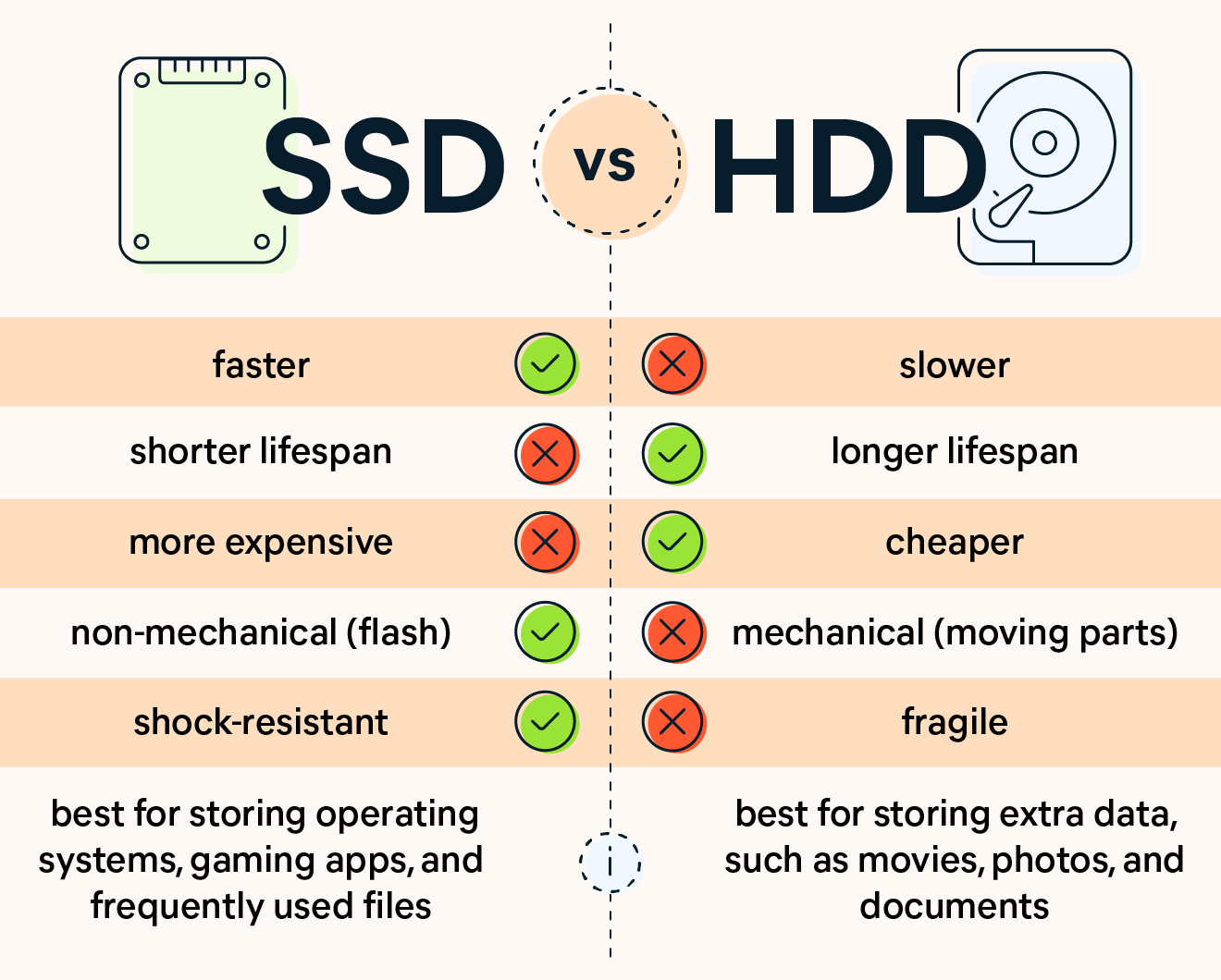

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)

![[Assorted] Comprehensive List of Postal Codes in Kenya: From A to Z](https://www.blog.nestict.com/wp-content/uploads/2024/08/The-5-Best-Keyboards-For-Typing-Summer-2024-Reviews-RTINGS.com_.jpg)

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)

Notifications