PROS CONS AND WAYS OF INVESTING IN BITCOIN, PROS CONS AND WAYS OF INVESTING IN BITCOIN It’s hard to predict whether this cryptocurrency will become the global reserve currency or a store of value as widely accepted as gold. The thrill of riches or ruin leaves some investors wary, but others want to chase the chance for substantial profits from investing in bitcoin. Like other cryptocurrencies, bitcoin can also be exchanged with the national currency of Kenya and other African currencies. Since its inception, Bitcoin was the 1st digital asset to beget the current ecosystem of cryptocurrency. As with all speculative disruptive investments, investing in bitcoin is risky. The safest exchanges are U.S.-based, which also means you’ll need to comply with the SEC’s know your customer (KYC) guidelines. Here are the steps to invest in bitcoin:

- Open an account with Coinbase or another exchange from the list below.

- Connect a bank account and deposit funds into your exchange wallet.

- Buy Bitcoin (BTC).

- Buy a wallet (optional).

- eToro

Trade popular cryptocurrencies, explore professionally managed portfolios and connect with traders. eToro currently supports the purchase and sale of 15 unique coins, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- TRON coin (TRX)

- Bitcoin Cash (BCH)

- Stellar Lumens (XLM)

- Dash (DASH)

- Litecoin (LTC)

- Ethereum Classic (ETC)

- Cardano (ADA)

- MIOTA (IOTA)

- EOS (EOS)

- NEO (NEO)

- Zcash (ZEC)

- Tezos (XTZ)

- Coinbase

Best For

- New cryptocurrency traders

- Cryptocurrency traders interested in major pairs

- Cryptocurrency traders interested in a simple platform

Coinbase makes it safe and simple for you to buy, sell and hold bitcoin. You can buy a portion of bitcoin with a %%post_content%% account minimum. Pay for purchases conveniently using your debit card or by connecting your bank account. Owning bitcoin on this brokerage is as simple as creating an account, verifying your identity, and buying your cryptos. Also, Coinbase has a program called Coinbase Earn that pays you to learn about cryptocurrencies. Take control of your bitcoin investment everywhere you go through the Coinbase mobile app. The brokerage allows you to hold onto your bitcoin, convert it into another crypto, spend it on expenses and transfer it to anyone, anywhere in the world.

- BitcoinIRA

BitcoinIRA’s proprietary platform enables you to self-trade crypto anytime so you can take action right when the market moves. Here’s how it works:

- Create an account. Get your customized dashboard and digital wallet after you create an account. Fund your account, access live pricing, and learn more with a knowledge base.

- Transfer funds. Transfer your IRA in 3 easy steps. Simply tell us how much you want to invest, how you want to fund your account, and your profile information. Most accounts will be ready to trade in just 3 to 5 days.

- Start trading. Trade digital assets inside your self-directed retirement account using our proprietary platform. Buy, sell or swap anytime, anywhere by visiting the self-trading area within your dashboard.

Advantages of Bitcoin Investments The overwhelming performance of bitcoin — as a currency and investment — has attracted traditional and institutional investors alike. Bitcoin as an investment tool provides you with the following advantages over traditional investments.

- Liquidity. Bitcoin is arguably 1 of the most liquid investment assets due to the worldwide establishment of trading platforms, exchanges, and online brokerages. You can easily trade bitcoin for cash or assets like gold instantly with incredibly low fees. The high liquidity associated with bitcoin makes it a great investment vessel if you’re looking for short-term profit. Digital currencies may also be a long-term investment due to their high market demand.

- Lower inflation risk. Unlike world currencies — which are regulated by their governments — bitcoin is immune to inflation. The blockchain system is infinite and there’s no need to worry about your cryptocurrency losing its value.

- New opportunities. Bitcoin and cryptocurrency trading is relatively young — new coins are becoming mainstream on a daily basis. This newness brings unpredictable swings in price and volatility, which may create opportunities for massive gains.

- Minimalistic trading. Stock trading requires you to hold a certificate or license. You must also go through a broker to trade a company’s shares. But bitcoin trading is minimalistic: simply buy or sell bitcoin from exchanges and place them in your wallet. Bitcoin transactions are also instant — unlike the settlement of stock trading orders, which could take days or weeks.

Disadvantages of Bitcoin Investments Bitcoin may be the future of monetary exchange, but it is equally important that you are aware of the concerns surrounding cryptocurrency investing. Here are some serious risks associated with bitcoin investments.

- Volatility. The price of bitcoin is always rippling back and forth. If you happened to buy bitcoin on December 17, 2017, the price was ,000. Weeks later, you couldn’t sell your investment for more than ,051. While you’d be doing great now in 2021, holding for years at a time is not a viable option for all investors.

- The threat of online hacking. While using a trusted exchange like Coinbase or Gemini will do wonders to lower your risk of being hacked, the only way you can be totally secure is by taking custody of your own private key. This can be done with a crypto wallet like the Ledger Nano X or Coinbase Wallet.

- No regulations by the government Satoshi Nakamoto, creator of bitcoin, designed bitcoin as a decentralized currency which means no governments or other central authorities are involved. No government means no regulations on the bitcoin market. Exposed to malpractices by hackers and fraudsters.

9 total views , 1 views today

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

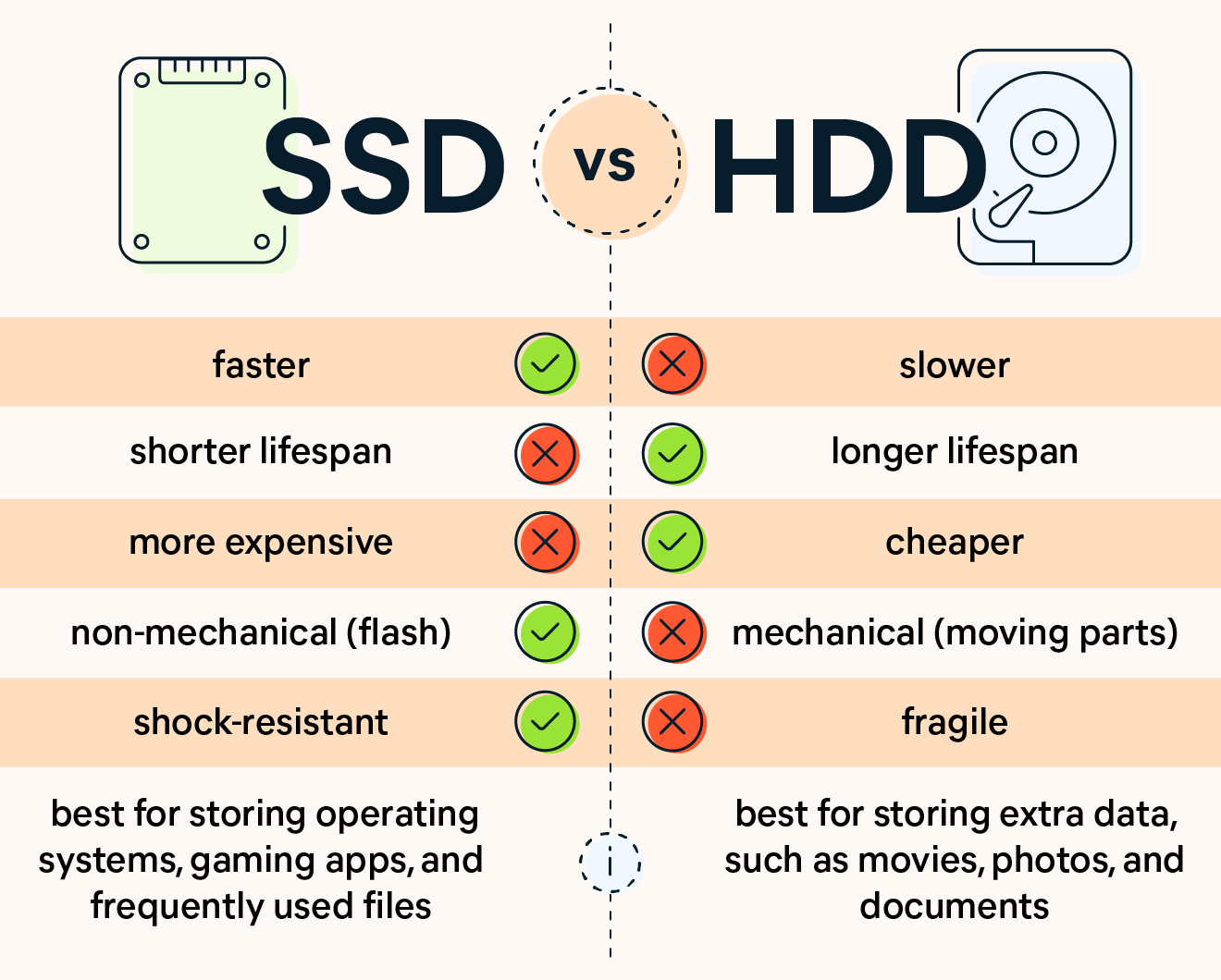

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)