Important

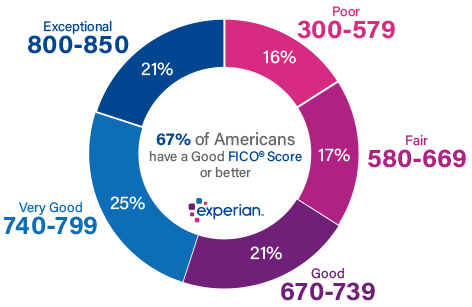

- Credit score ranges help lenders determine the risk of lending to a borrower.

- Credit scores are based on factors such as payment history, overall debt levels, and the number of credit accounts.

- You credit score can be a deciding factor on whether you are approved for a loan and at what interest rate.

- A FICO score between 740 and 850 is considered exceptional while scores between 700 to 750 are considered very good.

Credit Score Basics

Your credit score is a number that represents the risk a lender takes when you borrow money. A FICO score is a well-known measure created by the Fair Isaac Corporation and used by credit agencies to indicate a borrower’s risk.

Another credit score is the VantageScore, although the FICO score is more commonly used. Both FICO and VantageScore range from 300 to 850, although the ways in which each parses its scores into different classifications vary.

Your credit score calculation represents your credit risk at a moment in time based on information found on your credit report. The higher the credit score, the lower the risk to the lender.

Here are the FICO credit score ranges and what they mean.

Exceptional Credit Score: 800 to 850

A credit score in the range of 800 to 850 means the borrower is consistently responsible when it comes to managing their borrowing. Borrowers with these scores are more likely to qualify for the lowest interest rates.

People with this score have a long history of no late payments, as well as low balances on credit cards. Consumers with excellent credit scores may receive lower interest rates on mortgages, credit cards, loans, and lines of credit, because they are deemed to be at low risk for defaulting on their agreements.

Very Good Credit Score: 740 to 799

A credit score between 740 and 799 means the borrower is generally financially responsible when it comes to money and credit management.

Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. Credit card balances are relatively low compared with their credit account limits.

Good Credit Score: 670 to 739

Having a credit score between 670 and 739 places a borrower near or slightly above the average of U.S. consumers, as the national average FICO score was 714 in 2022.

While borrower in this credit score range may still earn competitive interest rates, they are unlikely to command the ideal rates of those in the two higher categories, and it may be harder for them to qualify for some types of credit. For instance, if a borrower is looking for an unsecured loan with this score, it’s vital that they shop around in order to find the options that best suit their needs with the fewest drawbacks.

Poor Credit Score: Under 580

An individual with a score between 300 and 579 has a significantly damaged credit history.

This may be the result of multiple defaults on different credit products from several different lenders. However, a poor score may also be the result of a bankruptcy, which will remain on a credit record for seven years for Chapter 13 and 10 years for Chapter 11.

You can improve your credit score by paying down debt, making timely payments, and avoiding opening new credit.

Borrowers with credit scores that fall in this range have very little chance of obtaining new credit.

If your score falls in it, talk to a financial professional about steps to take to repair your credit.

Additionally, so long as you can afford to pay a monthly fee, one of the best credit repair companies may be able to get the negative marks on your credit score removed for you. If you attempt to obtain an unsecured loan with this score, be sure to compare every lender you’re considering in order to determine the least risky options.

Fair Credit Score: 580 to 669

Borrowers with credit scores ranging from 580 to 669 are thought to be in the “fair” category.They may have some dings on their credit history, but there are no major delinquencies. They are still likely to be extended credit by lenders but not at very competitive rates.

![]()

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)