File Your 2024 Returns Now

As the year 2024 comes to an end, it’s time to start preparing for one of the most critical compliance tasks for every Kenyan taxpayer—filing your KRA annual returns. Starting January 2025, taxpayers will have the opportunity to declare their income and fulfill their obligations to the Kenya Revenue Authority (KRA) for the 2024 tax year.

Here’s everything you need to know about filing your KRA 2024 annual returns.

Who Should File KRA Annual Returns?

All individuals and entities with a KRA PIN are required to file annual returns, whether they earned taxable income during the year or not. This includes:

- Employed individuals: Ensure that your employer has issued you a P9 form reflecting your total income and taxes paid during 2024.

- Business owners: Declare your profits, losses, and expenses for 2024.

- Students or unemployed individuals: File a nil return to remain compliant.

Key Deadlines for 2024 Returns

- Filing Opens: January 1, 2025

- Deadline: June 30, 2025

Failure to file your returns by the deadline attracts penalties of up to KES 2,000 for individuals and KES 20,000 for companies, so it’s vital to file on time.

Documents Needed for Filing

To ensure a smooth filing process, gather the following documents in advance:

- KRA PIN – Your personal or business tax identification number.

- P9 Form – For employed individuals, issued by your employer.

- Bank Statements – For business owners, to verify income and expenses.

- NHIF and NSSF Statements – To claim allowable deductions.

- Other Supporting Documents – Rental income details, investment returns, etc.

Benefits of Timely Filing

- Avoid Penalties: Save money by avoiding late-filing fees.

- Stay Compliant: A clean tax record ensures you remain in good standing with KRA.

- Access to Services: Timely filing is necessary for services like applying for loans, tenders, or visas.

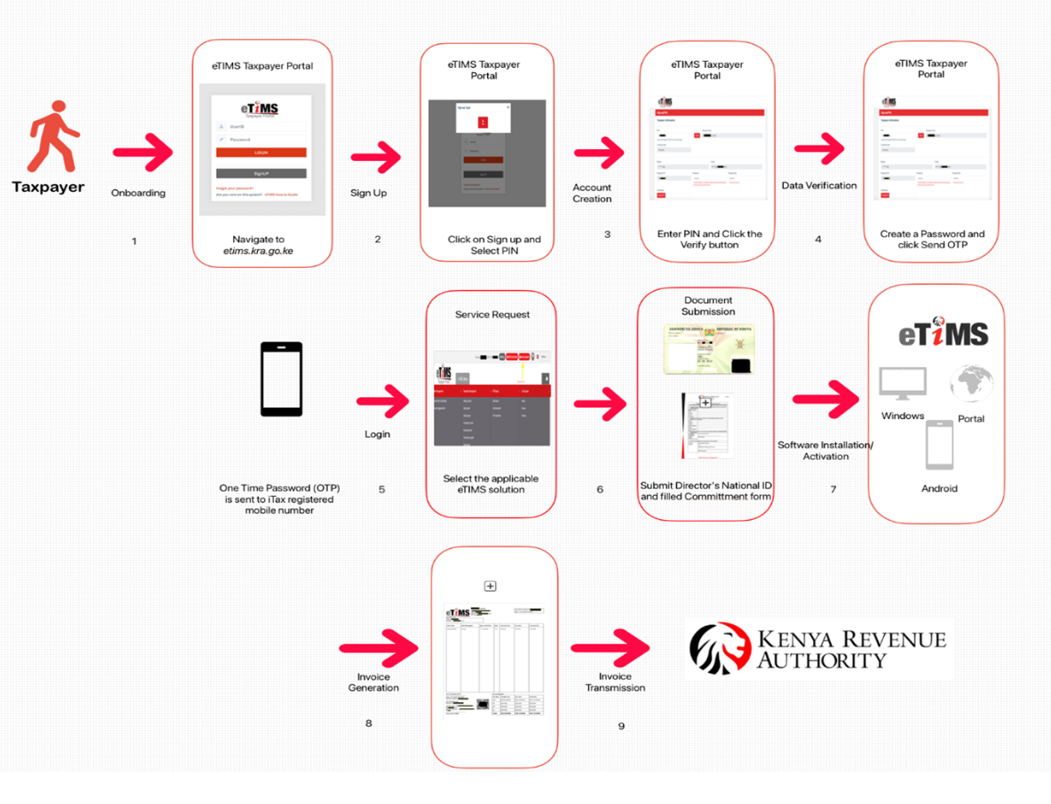

How Nestict Infotech Can Help

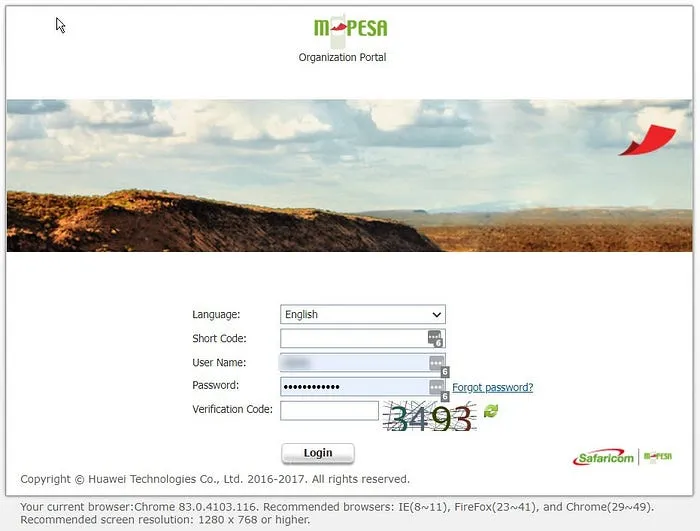

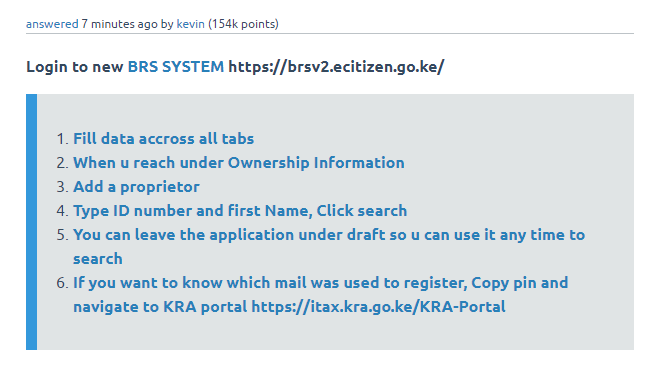

Filing your returns can be a daunting process, but you don’t have to do it alone. Nestict Infotech offers professional assistance to ensure your returns are filed accurately and on time. Our experts handle everything, from collating documents to submitting your returns on the iTax portal.

Book Your Filing Appointment Today

Avoid last-minute rushes and let us help you stay compliant. Book an appointment with Nestict Infotech to file your 2024 annual returns with ease. Click the button below to get started:

File Your 2024 Returns Now

Make 2025 stress-free by starting your KRA filing process early. Contact Nestict Infotech today and enjoy a seamless tax filing experience!

![]()

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

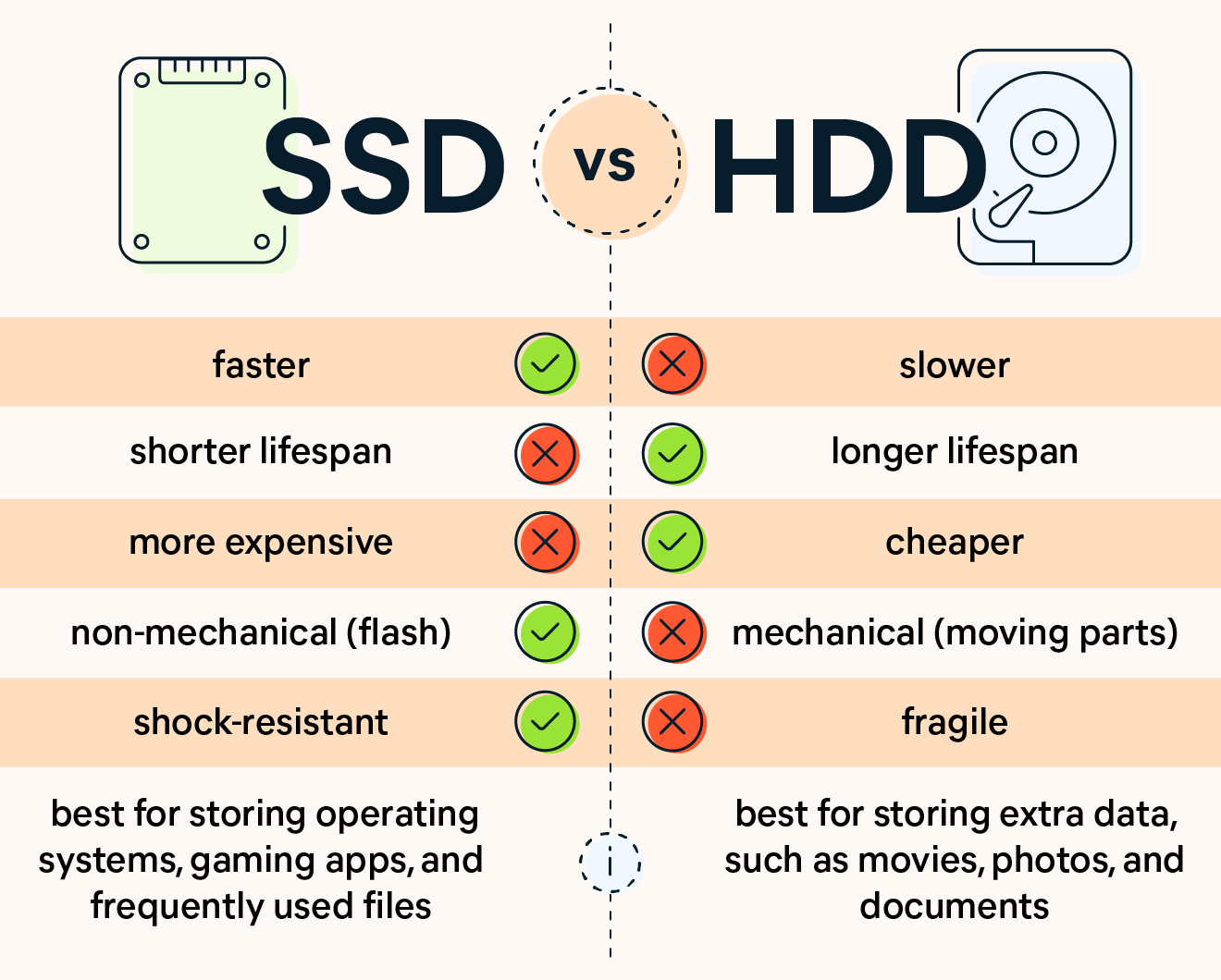

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)