Nestict.com Linktree

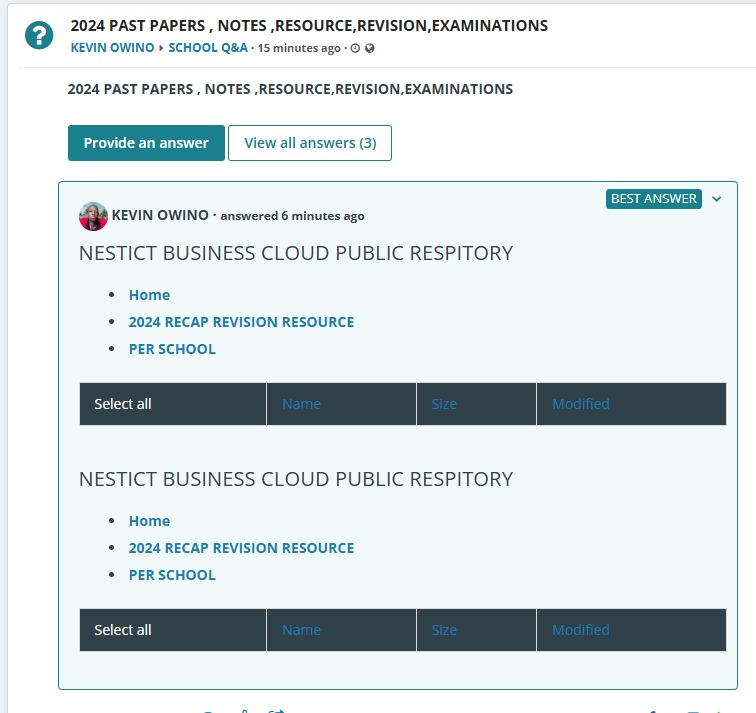

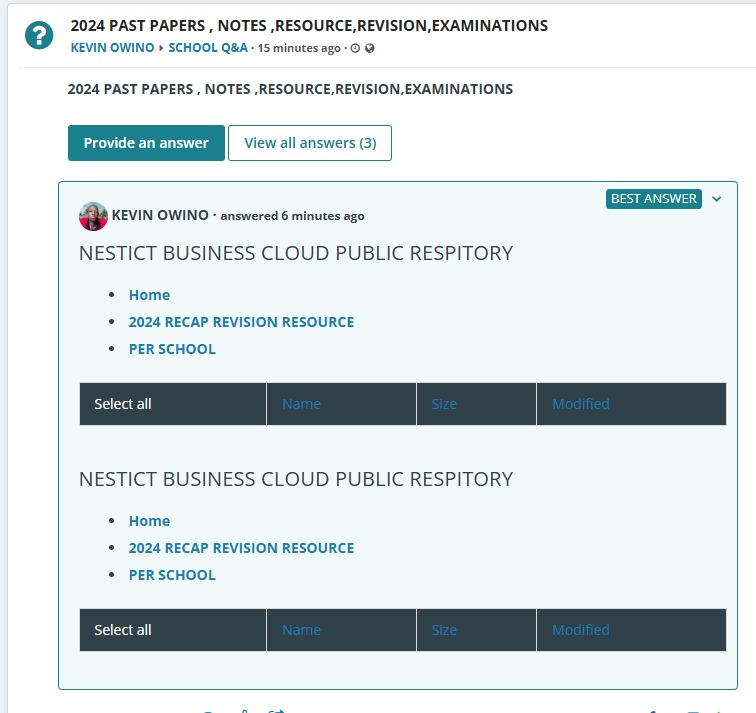

Forms CBC Leaving Form NPS Medical Examination Form Vendor Information Form JSS Exams Grade 7 Grade 7 Creative Arts & Sports Questions Grade 7 Christian Religious Education Questions Grade 7…

![]()

Felis consequat magnis est fames sagittis ultrices placerat sodales porttitor quisque.

Forms CBC Leaving Form NPS Medical Examination Form Vendor Information Form JSS Exams Grade 7 Grade 7 Creative Arts & Sports Questions Grade 7 Christian Religious Education Questions Grade 7…

![]()

Kenya’s postal codes, also known as postcodes, play a crucial role in ensuring accurate and efficient mail delivery across the country. These codes are assigned to specific regions, towns, and…

![]()

The National Social Security Fund (NSSF) in Kenya provides social security services, including retirement savings and benefits for workers. With branches distributed across the country, NSSF ensures that services are…

![]()

The Teachers Service Commission (TSC) is a government agency in Kenya mandated with the registration, employment, deployment, and management of teachers. TSC operates regionally to ensure its services are easily…

![]()

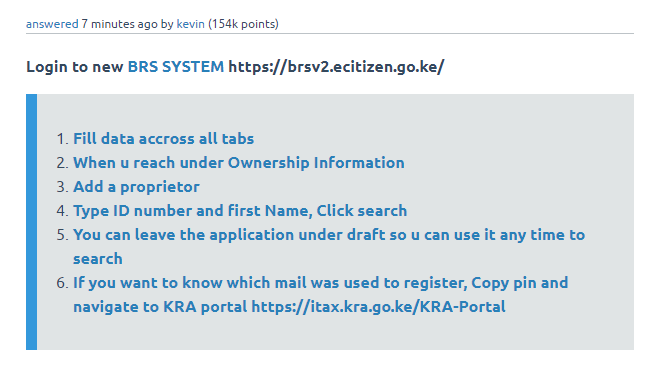

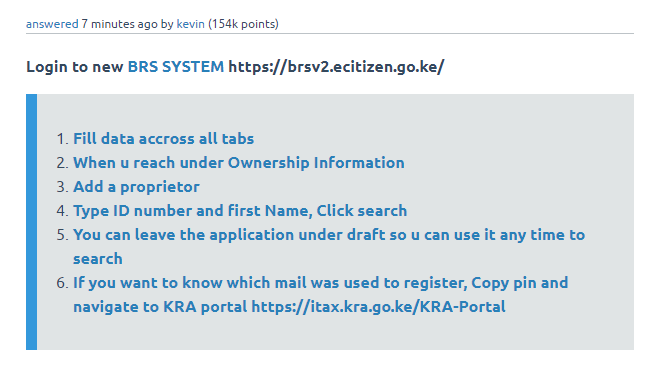

Step 1: Preparing Your VPS Before installing Webuzo, ensure your VPS is updated and ready for installation. Log in to your VPS via SSH: Open a terminal and connect…

![]()

Here is an alphabetical list of some Kenyan banks along with their SWIFT codes: Bank Name SWIFT Code ABSA Bank Kenya PLC BARCKENX Access Bank (Kenya) PLC ABNGKENA African Banking…

![]()

Introduction: Equity Bank is one of Kenya’s leading banks, offering services across the country through an extensive branch network. Each branch is assigned a unique bank code, which is crucial…

![]()

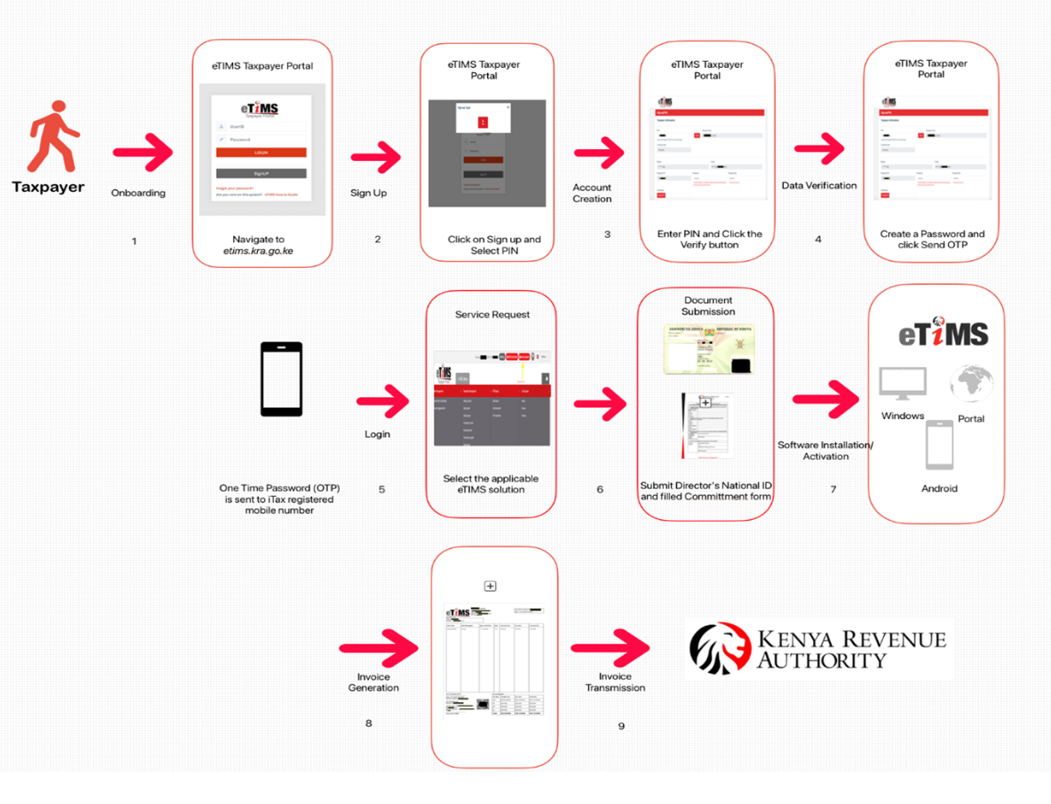

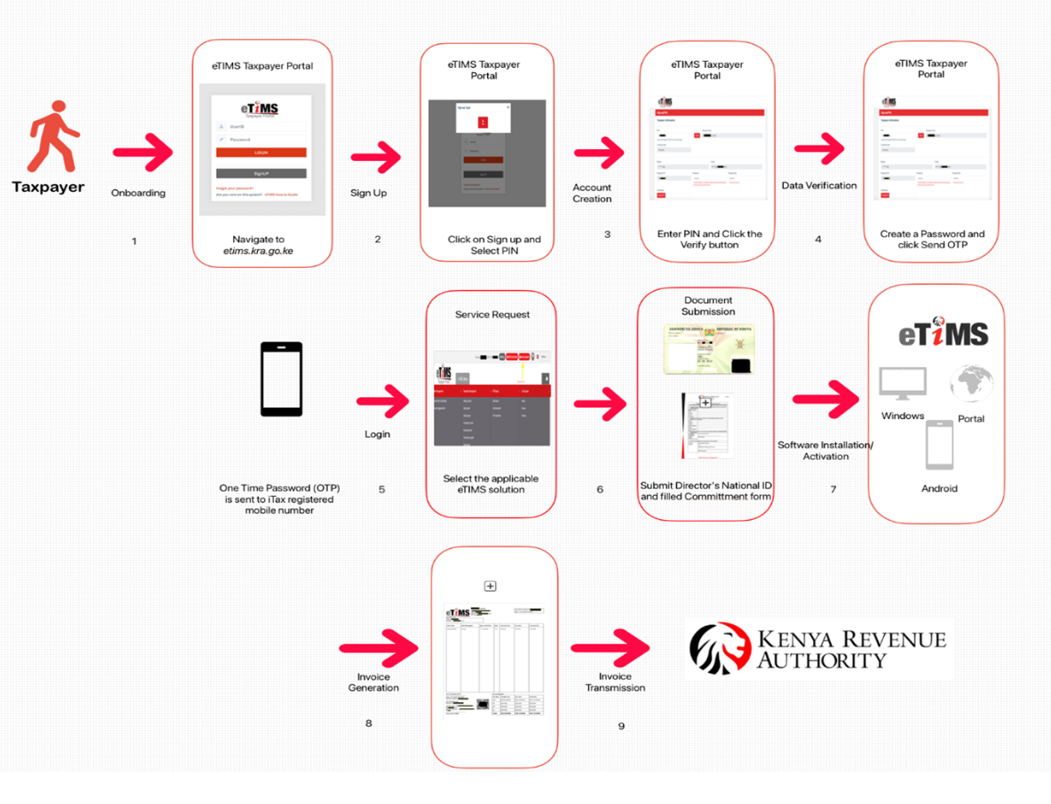

The Electronic Tax Invoice Management System (ETIMS) is transforming how businesses manage their tax obligations. Developed to streamline compliance with tax regulations, ETIMS is especially significant for enterprises in regions…

![]()

File Your 2024 Returns Now As the year 2024 comes to an end, it’s time to start preparing for one of the most critical compliance tasks for every Kenyan taxpayer—filing…

![]()

1. Situation: Climate Change and Global Warming Problem: Rising global temperatures, melting polar ice caps, and extreme weather events are wreaking havoc on ecosystems and human communities. Many people lack…

![]()

![[Assorted] Comprehensive List of Postal Codes in Kenya: From A to Z](https://www.blog.nestict.com/wp-content/uploads/2024/08/The-5-Best-Keyboards-For-Typing-Summer-2024-Reviews-RTINGS.com_.jpg)

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

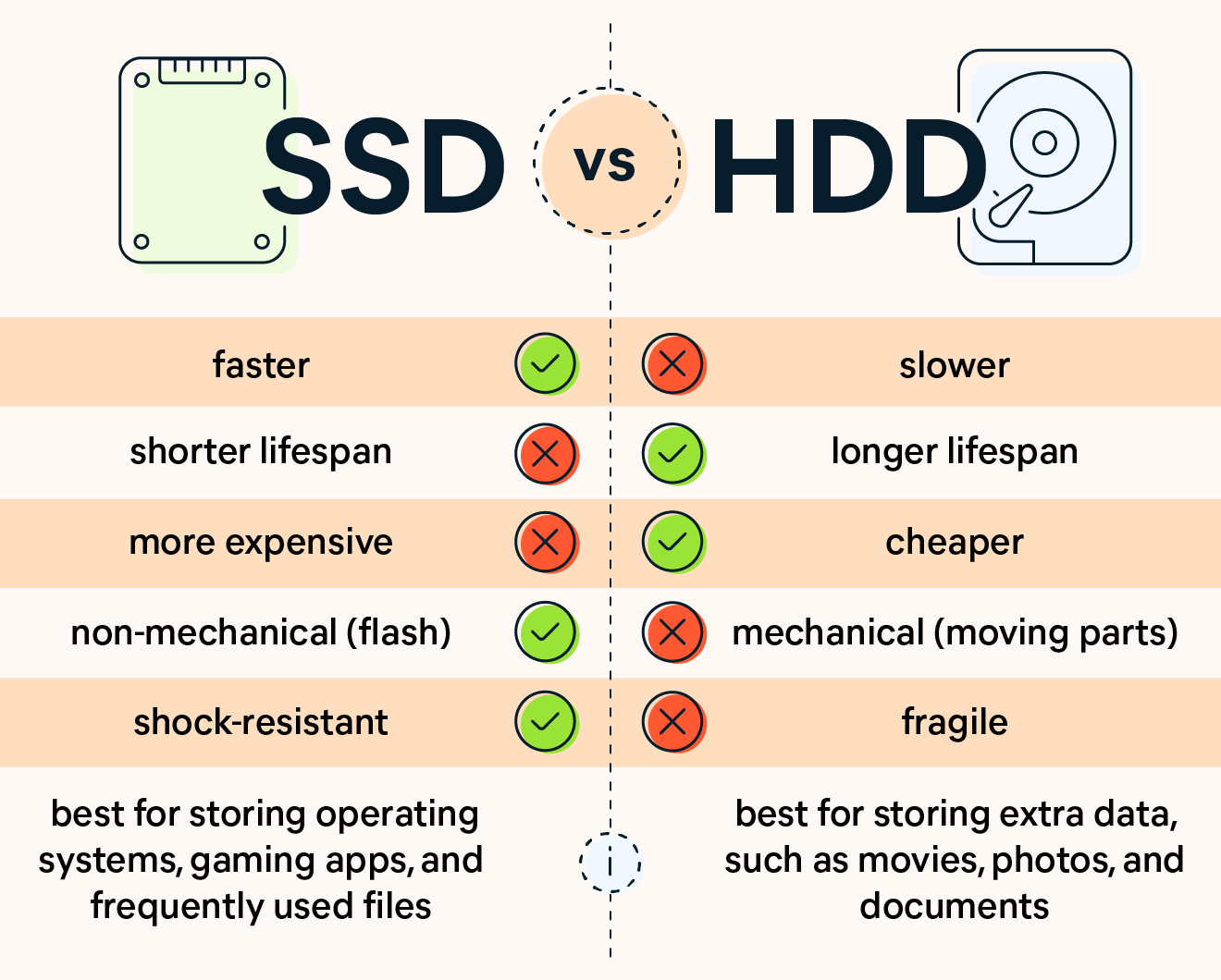

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)

![[Assorted] Comprehensive List of Postal Codes in Kenya: From A to Z](https://www.blog.nestict.com/wp-content/uploads/2024/08/The-5-Best-Keyboards-For-Typing-Summer-2024-Reviews-RTINGS.com_.jpg)

![[Resource]: Installing Webuzo on Your Nestict Cloud VPS: A Detailed Guide](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.webp)

![[Resource] : Comprehensive List of Equity Bank Codes Across Kenya by Region](https://www.blog.nestict.com/wp-content/uploads/2024/12/image-5.png)

![[Continuation]: Current Challenges in Making Physics and Geography Compulsory](https://www.blog.nestict.com/wp-content/uploads/2024/12/The-universe-of-mathematics-physic-and-astronomy-its-ama…-Flickr.jpg)

![[Resource] : Why Physics and Geography Should Be Compulsory Like Mathematics in Education](https://www.blog.nestict.com/wp-content/uploads/2024/12/image.png)

![[LINKTREE] 2024 PAST PAPERS , NOTES ,RESOURCE,REVISION,EXAMINATIONS](https://www.blog.nestict.com/wp-content/uploads/2024/10/SCHM.jpeg)

![Maritime Terms, Abbreviations and Acronyms [Shipping Terms – Searchable]](https://www.blog.nestict.com/wp-content/uploads/2024/09/Container-Stowage-Stock-Illustrations-–-71-Container-Stowage-Stock-Illustrations-Vectors-Clipart-Dreamstime.jpg)

![Maritime Terms, Abbreviations and Acronyms [ Shipping Terms]](https://www.blog.nestict.com/wp-content/uploads/2024/09/image.png)

![[Explainer]: NVMe storage, SSD (SATA SSD), and HDD](https://www.blog.nestict.com/wp-content/uploads/2024/08/Laptops-are-available-with-SSDs-and-HDDs.png)

![[Updated 2024] – Passport Application FOR CHILDREN ONLY(PERSONS UNDER 18 YEARS)](https://www.blog.nestict.com/wp-content/uploads/2023/09/keppp-240x172.png)

![[Updated 2024] -Passport Application FOR ADULTS ONLY-PERSONS OVER 18 YEARS](https://www.blog.nestict.com/wp-content/uploads/2023/09/EAF-Passport-e1631045054464-400x800-1-240x172.jpg)

Notifications